When it comes to investments, there are a lot of avenues which you can consider. If you don’t mind taking risks, investing in shares, stocks, mutual fund schemes and other market-linked investment avenues is recommended for attractive returns. However, if you are risk-averse and don’t want to risk your investment to market fluctuations, fixed income instruments should be your choice. When it comes to fixed income instruments, fixed deposits are mass favourites. A fixed deposit scheme gives you guaranteed returns on your investment depending on the tenure you choose.

Fixed deposits are offered by both banks and non-banking financial institutions. Each institution tries to offer you the highest deposit rate so that you choose that institution over its competitors. While you search for the highest interest rates, many of you don’t know how interests are calculated and what would be the final amount which you would get on maturity of the deposit. This is where a fixed deposit calculator comes into the picture. Let’s understand the calculator in details.

What is a fixed deposit calculator?

A fixed deposit calculator is a tool which shows the final amount receivable on maturity of the deposit and the total interest earned.

How does the fixed deposit calculator work?

For the fixed deposit calculator to work, three main inputs are required to be fed into the calculator. These inputs include the following –

- The amount of money invested – this is the first input which depicts the money which you intend to deposit into the scheme

- The tenure – fixed deposits have a range of tenure options starting from as low as 7 days and going up to 10 years. You can choose any investment tenure as per your requirement. Depending on the tenure you select, the total interest that you can earn would be calculated.

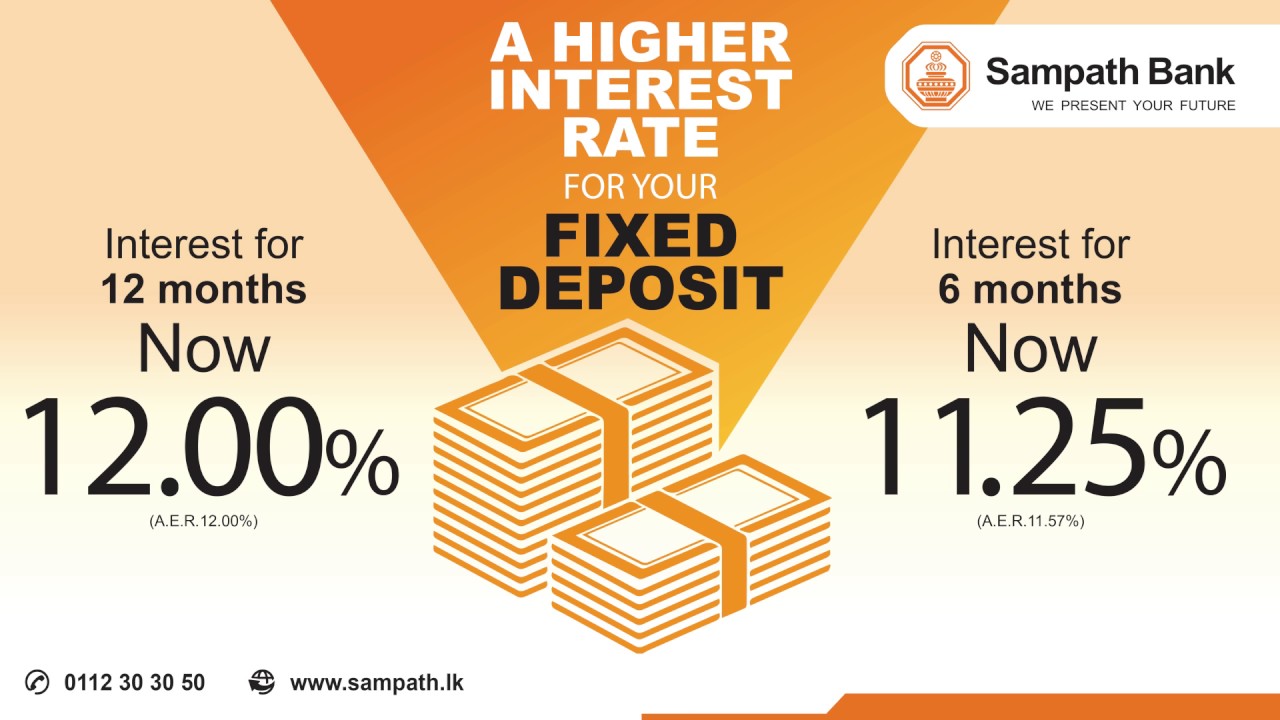

- The interest rate – the last input which is required is the applicable rate of interest. You have to enter the interest rate which the institution is allowing on your deposit. The rate depends on the tenure you select.

After these inputs are entered, the calculator calculates the total interest earned over the period of investment and also the amount receivable when the term of the deposit comes to an end.

Benefits of the fixed deposit calculator

The fixed deposit calculator has various benefits which include the following –

- You are freed from the task of calculating your returns yourself. The calculator is simple and calculates your returns easily and instantly

- You can find out the actual returns from your fixed deposit investments using the calculator

- When you use the fixed deposit calculator of an online aggregator, you can also compare the deposit schemes of different institutions and pick an institution which offers the highest interest rate

- You can also change the input details as per your suitability and get the updated results easily

So, the next time you think of investing in a fixed deposit scheme, use the fixed deposit calculator to calculate the expected maturity amount and interest earnings to get an idea of what the deposit promises.

Related article: How Fixed Deposit can help you in Saving Money